Have you ever watched the movie with Leonardo DiCaprio or the one with Ryan Gosling? No, I’m not talking about Titanic or The Notebook but rather The Wolf of Wall Street and The Big Short!

Besides having a star-studded cast, what do these two films have in common? Investments!

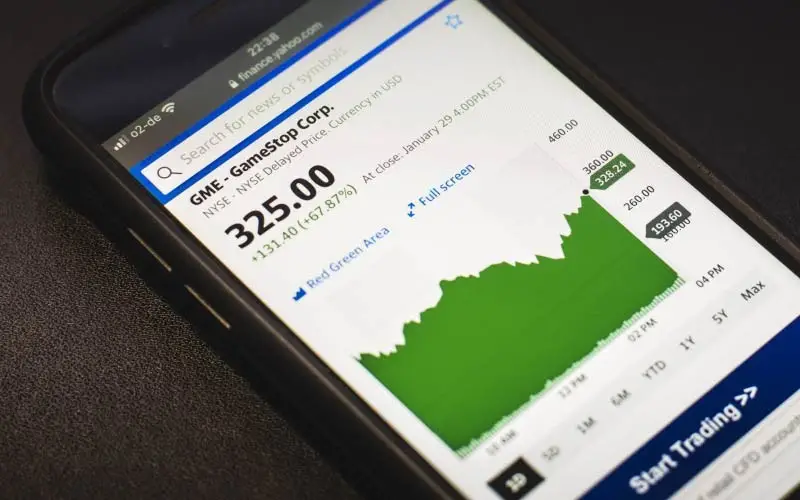

I’ve always been interested in investments (hence, my choice of electives), but between DiCaprio’s pep talk scene and Gosling’s famous ‘Jenga’ scene, these movies gave me the final push to actually start investing. Plus, with the recent GameStop episode (more on that soon), it really does feel like the time for amateur investors to shine.

But before you even consider investing to get returns, know what you’re getting yourself into. In financial terms, 'investment' simply means setting aside money or capital expecting to generate an income or profit in the future. Now that's done you know the basic definition of investment, it’s time to ask yourself: Why should I bother investing? I haven’t even finished my studies!

There are 3 main reasons why it’d be good to start investing while you’re still in university!

1: You’d have lesser financial responsibility in university than, say, your mid-30s. Though you may not have a full-time job just yet, you’d have some form of financial assistance either from your family or sponsors. Hence, you’re more likely to have some disposable income* a.k.a extra money.

2: Investing is another method to gain financial independence. After graduating, you’re most likely to land your first job and, more importantly, manage your own finances. By getting a head start, you can be assured that your personal finance will be in check when you enter adulthood.

3: You’ve the leverage of time! If you can invest for a longer period of time, you’re more likely to get higher returns! Ka-ching!